2015 Estate Planning Update

Estate Tax Update

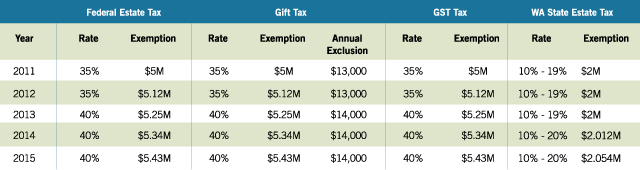

Federal Estate Tax, Gift Tax and Generation-Skipping Tax Exemptions

The 2015 federal exemption against estate, gift, and generation-skipping taxes is $5,430,000 per person. This is an increase over the 2014 exemption, which was $5,340,000 per person. The $90,000 exemption increase is an inflation adjustment. Estates in excess of this amount are subject to a 40% Federal Estate Tax.

State Estate Tax Exemption

The 2015 Washington state estate tax exemption is $2,054,000 per person. This is an increase over the 2014 exemption, which was $2,012,000 per person. The $42,000 exemption increase is an inflation adjustment. Washington estates in excess of this amount are subject to a 10% – 20% Washington State Estate Tax. Even though the state estate tax exemption has been increased to $2,054,000, the filing threshold for the Washington State Estate and Transfer Tax Return remains at $2,000,000. Each estate over $2,000,000 is required to file a Washington State Estate and Transfer Tax Return.

Federal Gift Tax Annual Exclusion

The annual exclusion against federal gift tax remains at $14,000 for 2015.

Federal and State Tax Summary

The chart below outlines the federal and state exemptions and tax rates for 2011 through 2015.

Estate Planning Update

Beneficiary Deeds

Effective on June 12, 2014, Washington allows an individual to use a Beneficiary Deed, otherwise known as a Transfer on Death Deed, to transfer real property to a designated beneficiary or beneficiaries at the time of an owner’s death.

To be valid, a Beneficiary Deed must be executed and recorded and the grantor of the deed must have testamentary capacity when naming the beneficiary.

A beneficiary named on a Beneficiary Deed does not acquire any rights to the owner’s property while the owner is alive, nor will the property be exposed to the beneficiary’s creditors. The owner can name a contingent beneficiary to receive the property if the primary beneficiary is not living, and can revoke the deed or change the beneficiary at any time.

LLC Conversion Statutes

In various instances, it is beneficial to convert an LLC into a corporation or partnership or vice versa. Under Washington law these conversions required two or three steps involving formation of a new entity and either a merger or a transfer of assets and a dissolution.

A new Washington law, effective June 2014, streamlines and simplifies this process by allowing a direct, one-step conversion process between LLCs, corporations, and limited partnerships.

An organization that has been converted is for all purposes the same entity that existed before the conversion. The title to all real estate and other property remains vested and unimpaired in the converted organization. All debts and liabilities remain as obligations of the converted organization. Any lawsuit by or against the converting organization continues as if the conversion had not occurred.

Domestic Partnership Conversion

On November 6, 2012, legislation was passed allowing same-sex couples to marry in Washington State. The law took effect on December 6 and on December 9, after a legislatively required three day waiting period, the first same-sex marriages in the state took place.

The same legislation required most, but not all, domestic partnerships registered with Washington State to be converted to marriages if not dissolved earlier. As of June 30, 2014, all registered domestic partnerships

(1) between same sex couples where (2) both parties were under age 62, have been converted to marriages.

Like changes to any law, it takes time to settle issues that arise as a result of the change. Take for instance the issue of a domestic partnership agreement. Suppose that you and your partner entered into a same sex domestic partnership agreement prior to registering with the state. You and your partner later married or had your partnership converted to marriage. Your domestic partnership agreement may not be valid. If you executed a domestic partnership agreement and are now married, we recommend that you come in and review the agreement to ensure your desires are still binding.

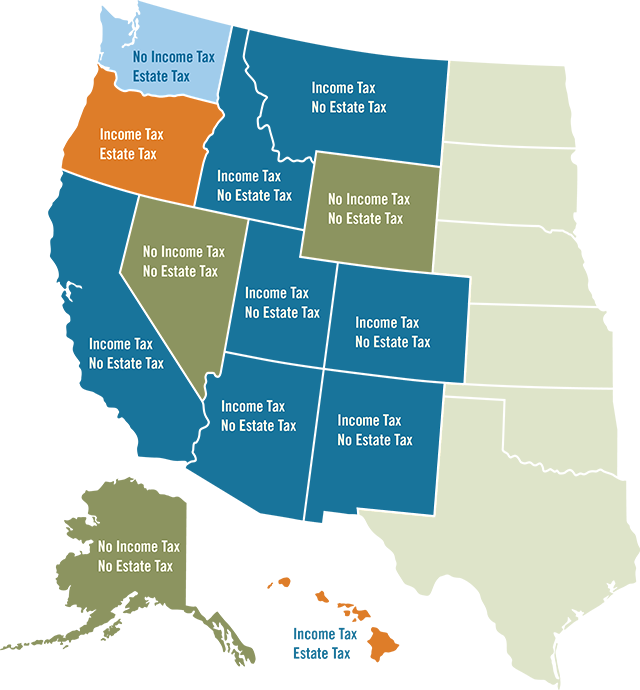

Work in Washington, Die in Nevada?

For high net worth clients with residences in more than one state, choosing one state to be their domicile could be a difficult decision but can result in significant tax savings. This map shows which western states impose an income and estate tax on residents.

- There is no one factor that conclusively determines domicile. However, major factors the courts and the IRS have applied in determining domicile for estate tax purposes include:

- Place of birth;

- Current place of residence;

- Relative amount of time spent in each state;

- Statements in legal documents such as wills, trusts, deeds, etc., with respect to domicile and ownership of real estate;

- State in which the person holds a driver’s license;

- State in which the person has vehicle(s) registered;

- Place to which one returns from trips;

- State in which one is registered to vote;

- State in which one claims as a residence for obtaining a hunting or fishing license, eligibility to hold public office, or for judicial actions;

- Address listed on federal and state income tax returns, and whether the state return is filed as a resident or nonresident;

- Family ties, and location of the remains of deceased family members;

- Location of bank accounts, brokerage accounts, and safety deposit boxes;

- The extent and value of tangibles located in claimed domicile;

- Location of pets and public library cards;

- Location of memberships where individual is active including: charitable organizations, churches, political organizations, and social/athletic clubs;

- Local newspaper subscriptions; and

- Location of professional services (CPA, attorney, insurance broker etc.).

Non-Tax Reasons to Make Sure Your Estate Plan is Up to Date

The changing demographics of our society are presenting new challenges that can be overcome with creative estate planning. An article published by the Cannon Financial Institute, Inc. in December 2014 set forth some interesting demographic statistics:

- The Aging Population. Between 2000 and 2020, the number of Americans over the age of 65 will nearly double.

- Blended Families. An estimated 40% of married couples include at least one spouse with a child from a previous relationship.

- The “Sandwich” Generation. An estimated 40% of the baby boomers are supporting an elderly parent and a dependent child.

If you find yourself relating to one or all of these statistics it might be time to meet with your trusted estate planning lawyer to review your plan.

Contact the Authors

Laura Hoexter

206.689.2153

[email protected]

R. Thomas Olson

206.689.2150

[email protected]

Liberty Upton

206.689.2134

[email protected]