2016 Estate Planning Update

Estate Tax Update

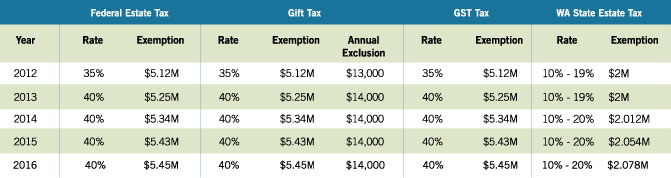

Federal Estate Tax, Gift Tax and Generation-Skipping Tax Exemptions

The 2016 federal exemption against estate and gift taxes is $5,450,000 per person. This is an increase over the 2015 exemption, which was $5,430,000 per person. The $20,000 exemption increase is an inflation adjustment. Estates in excess of this amount are subject to a 40% federal estate tax. The federal generation-skipping transfer tax exemption was also increased to $5,450,000 per person.

State Estate Tax Exemption

The 2016 Washington State estate tax exemption is $2,079,000 per person. This is an increase over the 2015 exemption, which was $2,054,000 per person. The $25,000 exemption increase is an inflation adjustment. Washington estates in excess of this amount are subject to a 10% – 20% Washington State Estate Tax. Even though the Washington State estate tax exemption has been increased to $2,079,000, the filing threshold for the Washington State Estate and Transfer Tax Return remains at $2,000,000. Each estate over $2,000,000 is required to file a Washington State Estate and Transfer Tax Return.

Federal Gift Tax Annual Exclusion

The annual exclusion against federal gift tax remains at $14,000 for 2016.

Federal and State Tax Summary

The chart below outlines the federal and state exemptions and tax rates for 2012 through 2016.

Estate Planning Update

Supreme Court States Inherited IRAs Are Not Exempt from Creditors’ Claims

If you have an Individual Retirement Account (IRA), funds held in your account are exempt from your creditors. In other words, if you are in a car accident and a judgment is awarded against you, your IRA cannot be seized as payment. However, it was unclear previously whether the beneficiaries who received your IRA following your death would receive the same creditor protection that you received. Recently, in Clark v. Rameker, the US Supreme Court clarified this. The Court reasoned that Inherited IRAs (e.g., IRAs left to a spouse, children, grandchildren, or friends upon a participant’s death) are not “retirement funds” and therefore do not receive creditor protection. The one exception to this rule is for IRAs left to a surviving spouse who then “rolls over” the IRA and treats it as his/her own account. In this case, the IRA will remain creditor protected.

IRA Trusts – Creditor Protection For Inherited IRAs

When one door closes, another opens. In the wake of Clark v. Rameker, IRA Trusts have become much more popular. While an Inherited IRA left to an individual is not protected from that individual’s creditors, an IRA left to an IRA Trust for the benefit of an individual can be protected from that individual’s creditors. An IRA Trust is a trust specifically designed to allow the IRA to remain tax-deferred – stretching the required minimum distributions from the IRA over the life expectancy of the beneficiary. The IRA Trust can allow these distributions to be accumulated in the trust and held for the beneficiary’s benefit, or the distributions can pass directly to the beneficiary. If the IRA Trust includes language that prohibits the IRA Trust beneficiary from voluntarily or involuntarily alienating his or her interest in the IRA Trust (commonly referred to as a “spendthrift” provision), the beneficiary’s creditors cannot reach the funds in the IRA or in the IRA Trust

Assisted Reproduction – Who Owns the Genetic Materials?

In 2013, the American Society of Reproductive Medicine announced that freezing unfertilized eggs for later fertilization was no longer experimental technology. Since then, a growing number of women have been freezing their eggs for future use. National Public Radio reports that meetings are being held across the country (commonly called “Wine and Freeze” nights) where women learn about the costs, the procedures, and the statistics on frozen eggs resulting in pregnancy. Add these women to the growing numbers using other assisted reproduction technologies such as in vitro fertilization and there is a significant amount of genetic material being collected and stored. This has led to some very difficult legal questions: Who has a right to say what happens to this genetic material upon death? Upon divorce? What if one party changes his or her mind?

For the most part, ownership and use of genetic material are addressed by the contract the parties enter into with the clinic or storage facility. However, when there is no contract or the contract doesn’t address a specific situation, parties may find themselves in a courtroom arguing over their respective legal rights. Actress Sofia Vergara is currently involved in litigation with her ex-boyfriend over the ownership of two embryos the former couple had frozen. Sofia wants the embryos destroyed, but her ex-boyfriend wants them implanted in a surrogate and brought to term. A case like this highlights the need for individuals and couples who are considering storing or have stored genetic material to thoroughly read any contract presented to them by a clinic or other storage facility, and discuss the outcomes of various situations that may arise. If the standard contract is insufficient, parties may want to consider executing a separate contract that addresses these issues. The storage of genetic materials should also be discussed with your estate planning attorney as the answers to these issues will shape the definition of children and descendants in your Will.

Enforceability of a Health Care Directive When Pregnant

After being declared brain-dead, a 33-year old Texas woman, Marlise Muñoz, was kept on a ventilator for two months. While she did not have a written directive regarding end-of-life care, she had expressed her wishes to her family, who all agreed that the ventilator should be removed. However, the hospital refused to do so because Marlise was 14 weeks pregnant. The issue in Texas revolved around a state law that said life-support cannot be terminated for a pregnant woman, regardless of her written directions or the desires of her family. Ultimately, a judge dodged the legal issue and ruled that Marlise was already legally dead. Therefore, the withdrawal of the ventilator was not “terminating life-support.”

While Washington does not have an analogous statute, the sample directive language provided in Washington’s Natural Death Act addresses the intersection of life-support and pregnancy. Specifically, the sample language states if a woman is pregnant, the directive has no effect. However, unlike Texas, Washington residents have the ability to modify, add, and/or remove provisions from the directive, presumably including removing the provision that annuls the directive in the event of pregnancy. While Marlise’s family’s decision may have been honored if she had been in Washington, this case serves as an unfortunate reminder of the importance of clearly recording an individual’s wishes regarding end-of-life decisions, and for women, specifically considering those decisions in the context of pregnancy.

Contact the Authors

Laura Hoexter

206.689.2153

[email protected]

R. Thomas Olson

206.689.2150

[email protected]

Liberty Upton

206.689.2134

[email protected]