2019 Estate Planning Update

Estate Tax Update

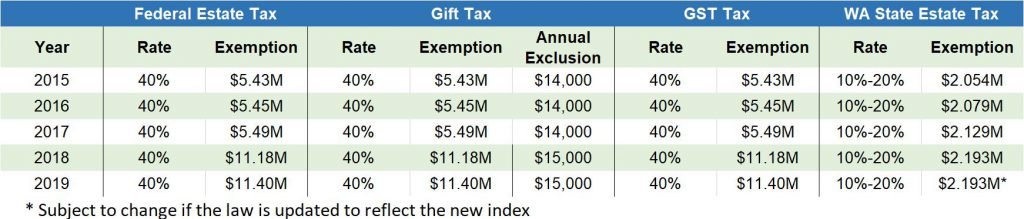

Federal Estate Tax, Gift Tax and Generation-Skipping Tax Exemptions

The 2019 federal exemption against estate and gift taxes is $11,400,000 per person. This is an increase over the 2018 exemption, which was $11,180,000 per person (the increase reflects an inflation adjustment). The exemption is expected to drop by 50% at the end of 2025. Gifts and estates in excess of the exemption amount are subject to a 40% federal estate tax. The federal generation-skipping transfer tax exemption was also increased to $11,400,000 per person.

State Estate Tax Exemption

The 2019 Washington State estate tax exemption is $2,193,000 per person, the same exemption as 2018. An inflation adjustment was not made for 2019 because of a technical oversight. Washington law states that exemption increases are linked to the consumer price index (“CPI”) for the Seattle-Tacoma-Bremerton area. However, the bureau of labor statistic recently changed the geographic area for the CPI to the Seattle-Tacoma-Bellevue area. Without a corresponding change to the law, the exemption is still linked to the old CPI and remains unchanged. If the law is changed to reference the new CPI, then the exemption should increase. Estates in excess of the exemption amount are subject to a 10% – 20% Washington State estate tax.

Federal Gift Tax Annual Exclusion

The federal annual gift tax exclusion remains at $15,000 for 2019.

Federal and State Tax Summary

The chart below outlines the federal and state exemptions and tax rates for 2015 through 2019.

Estate Planning Update

IRS GUIDANCE FOR THOSE MAKING LARGE GIFTS

The 2017 Tax Cuts and Jobs Act (“2017 Tax Act”) temporarily raised the federal estate and gift tax exemption from $5 million (indexed for inflation) to $10 million (indexed for inflation). In 2019, the federal estate and gift tax exemption with the inflation adjustment is $11,400,000 per person. However, this provision increasing the exemption expires at the end of 2025 and unless there is a change in the law, the exemption will revert to $5 million (indexed for inflation). The IRS calculates your taxable estate by adding together the funds left in your estate at your death and the value of all gifts you have made during your lifetime, and then subtracting the exemption amount in effect at the time of your death. This has left many taxpayers wondering what will happen if they use their exemption now to make large gifts only to have the exemption revert to $5 million (indexed for inflation) after 2025.

For example, take Joe, an 85-year-old man with a $16,400,000 estate. In 2019, Joe makes a gift of $11,400,000 million to his children, leaving him with an estate of $5 million. If Joe dies in 2025 with a $5 million estate, the IRS will calculate his taxable estate by adding together the funds remaining in his estate ($5 million) and the value of all prior gifts made ($11,400,000), and subtracting the exemption at the time of death ($11,400,000). The IRS will then assess a tax on Joe’s $5 million taxable estate (($11,400,000 + $5,000,000 = $16,400,000) – $11,400,000 = $5,000,000). However, if Joe dies in 2026 when the exemption reverts to $5 million (indexed for inflation), Joe’s taxable estate will be $11,400,000 (($11,400,000 + $5,000,000 = $16,400,000) – $5,000,000 = $11,400,000). This means that Joe will be taxed at death on funds he gave away during his lifetime. To put it another way, under this formula, the IRS will “claw back” the gift Joe made during his lifetime and tax it upon his death.

On November 20, 2018, the IRS issued proposed regulations stating that there will be no clawback when current exemption levels decrease after 2025. The proposed formula to calculate the taxable estate will add your remaining estate at death and all gifts made during your lifetime, and then subtract the greater of (1) the exemption at the time of your death, or (2) the exemption at the time the gift was made. This proposed change provides much needed relief to many taxpayers and estate planners. Although taxpayers cannot rely on proposed regulations for planning purposes, this proposed regulation is expected to be finalized in the first quarter of 2019. Barring any dramatic changes to the proposed regulations, a taxpayer will be able to take advantage of the increased exemption to make large gifts without worrying that the gifts might be subject to a clawback tax. If you would like to discuss making gifts (large or small), please contact any attorney in Helsell’s Estate Planning Department.

Tax Fun Fact #1: Approximately 90% of people who employ housekeepers and babysitters cheat on their taxes.

PLANNING FOR PETS

Pets are an important part of our families, yet they are often overlooked when drafting estate planning documents. Many of us have friends or family who will happily take in and care for our pets. But caring for pets can be very expensive, especially as they age. What if the desired person cannot afford to care for your pet? Or what if your children are too young or too mobile to be able to care for your pets? Don’t worry – you have options.

If you know someone who would be a great caretaker for your pet, but you do not want to burden him/her with the added expenses associated with caring for your pet, you can leave that person your pet, together with funds to care for your pet. Alternatively, you can establish a Pet Trust for any animal with a vertebrae (sorry, no Pet Trusts for crabs or octopuses). A Pet Trust is a fund that you set up to ensure that money is available to the pet caretaker to provide for your pet’s needs (food, veterinary visits, toys, and any other expenses you wish to cover). You choose the person who will invest the funds and make distributions from the account (“the Trustee”) and you also choose the pet caretaker. The Trustee and the pet caretaker may be the same person or different people. The Pet Trust assures that as your pet changes homes, there are funds available to provide for its care.

If you do not have someone who will be an ideal caretaker for your pet, you can explore options offered by your local pet organizations, such as the Seattle Humane Society’s Pet Guardianship Program. For a small charitable contribution, Seattle Humane will allow you to register up to 5 pets (cats, dogs, and other small critters) to be cared for by the organization in the event of your incapacity or death. If you pass away or become incapacitated, the Seattle Humane Society will pick up your pet (assuming you live within 100 miles), and care for it until you regain capacity or until they find another “forever home” for your pet. If you have more than one pet, they will keep them together if you so request or if they feel it is beneficial for the pets. Remember, your pets are dependent upon you, and it is important to ensure that you have made provisions for their care in your estate plan. For more information on providing for your pets please contact any attorney in Helsell’s Estate Planning Department.

Tax Fun Fact #2: The largest tax evasion case in the history of the US is the 2006 case of Walter Anderson, a telecommunications executive. He admitted to hiding $365 million of income during the 1990s, which resulted in a 9-year sentence and a fine of almost $400 million in back taxes, fees, and penalties.

OPPORTUNITY ZONES create Opportunity for Capital Gain Deferral

The 2017 Tax Cuts and Jobs Act created the Opportunity Zone Program, a program designed to spur economic development by providing tax incentives to investors. The program identifies certain economically deprived areas (“Qualified Opportunity Zones”) and incentivizes taxpayers to invest in businesses in these areas (“Qualified Opportunity Funds”). The Opportunity Zone Program is currently effective and the incentives expire December 31, 2026.

Washington’s Opportunity Zones

The Governor of each state is able to designate up to 25% of the total number of eligible census tracts as Opportunity Zones. To qualify for Opportunity Zone status, a census tract must have an individual poverty rate of at least 20% and median family income up to 80% of the area median.

Washington State has a total of 555 census tracts that meet the eligibility criteria. On April 20, 2018, Governor Inslee identified the 25% or 139 tracts that will receive Opportunity Zone status. These tracts include diverse geographic areas, ranging from urban, rural, and suburban areas to tribal lands, industrial areas, and port areas. In the Seattle area, there are Opportunity Zones in Yesler Terrace, Squire Park, Cherry Hill, and Chinatown-International District. In the greater Puget Sound area, there are Opportunity Zones in downtown Tacoma, downtown Everett, and Paine Field.

What is a Qualified Opportunity Fund?

A Qualified Opportunity Fund is any corporation or partnership that primarily invests in an eligible business that owns property located in an Opportunity Zone.

An eligible business is a trade or business that has the following attributes: (1) at least 50% of the business’ total gross income is derived from the active conduct of a business within a Qualified Opportunity Zone; (2) a substantial portion of the business’ intangible property is used in the active conduct of the business within a Qualified Opportunity Zone; (3) less than 5% of the average of the aggregate unadjusted bases of the business property is attributable to nonqualified financial property, and (4) the business is not a private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store that primarily sells alcoholic beverages for consumption off premises.

What are the Tax Incentives?

There are two types of tax incentives provided: (1) tax deferral, and (2) tax minimization. Under the new law, investors are able to defer paying taxes on capital gains on the sale or exchange of assets if the sale or exchange is not between related parties, and the gains are invested in a Qualified Opportunity Fund within 180 days of the sale. The deferral of capital gains recognition will last until the earlier of the time when the investment is sold or exchanged, or December 31, 2026. The tax incentive only applies to federal capital gains taxes; it does not affect states that impose their own capital gains taxes.

If the investor holds the investment in the Qualified Opportunity Fund for a certain amount of time, the investor is eligible to increase his/her basis. If the Qualified Opportunity Fund is held for a period of more than 5 years, the basis is increased by an amount equal to 10% of the gain that was initially deferred. If the investment is held for a period of more than 7 years, the basis is increased by an additional 5% of the initial deferred gain. Finally, if the investment is held for a period of more than 10 years, and the investor elects, the basis is increased to the fair market value of the investment on the date it is sold or exchanged.

The Opportunity Zone Program is intended to help solve some of the economic challenges that the Qualified Opportunity Zones face. Investors with low basis portfolios looking for an opportunity to defer or minimize gain while providing some relief to economically challenged areas may want to consider this program. For more information on Qualified Opportunity Zones, please contact any attorney in Helsell’s Tax Department.

Newman’s Own Scores a Win

Newman’s Own Foundation, which has donated over $500 million to charities over 35 years, has been fighting to change the law that requires private foundations to divest themselves investments referred to as “excess business holdings.” An excess business holding is an ownership interest of more than 20% in a for-profit company. A private foundation owning excess business holdings for a period of more than 5 years will be subject to an extremely prohibitive excise tax of 200% of the value of the holdings in excess of the 20% threshold. Under certain circumstances, companies can request and receive a 5-year extension to own excess business holdings before the excise tax applies.

Newman’s Own Foundation is a private foundation that owns 100% interest in No Limit LLC. The LLC is a for-profit company that produces and sells the Newman’s Own-branded line of salsas, dressings, and other food products.

For Newman’s Own Foundation, the 5-year deadline to divest itself of No Limit LLC expired in 2013. However, the Foundation was able to get a 5-year extension, requiring it to divest itself of No Limit LLC by the end of 2018.

In February, the Bipartisan Budget Act of 2018 which included the Philanthropic Enterprise Act of 2017, or what most refer to as “the Newman’s Own Exception,” became effective, ending the Foundation’s long struggle to avoid the impending 200% excise tax.

The Newman’s Own Exception states that the tax on excess business holdings no longer applies to private foundations owning a for-profit business if the business meets certain ownership rules, distributes all profits to the parent private foundation, and operates independently of the foundation. Because No Limit LLC meets these requirements, Newman’s Own Foundation will be allowed to retain its ownership in the Newman’s Own brand.

While not extremely common, there are a number of business owners who wish to donate their businesses to charitable organizations after their passing. With the new the Newman’s Own Exception, we expect to see more private foundations owning and running for-profit businesses.

Contact the Authors

Laura Hoexter

206.689.2153

[email protected]

Liberty Upton

206.689.2134

[email protected]