2020 Estate Planning Update

Estate Tax Update

Federal Estate Tax, Gift Tax and Generation-Skipping Tax Exemptions

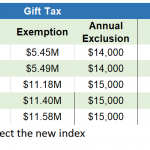

The 2020 federal exemption against estate and gift taxes is $11,580,000 per person. This is an increase over the 2019 exemption, which was $11,400,000 per person (the increase reflects an inflation adjustment). The exemption is expected to drop by 50% at the end of 2025. Gifts and estates in excess of the exemption amount are subject to a 40% federal estate tax. The federal generation-skipping transfer tax exemption was also increased to $11,580,000 per person.

State Estate Tax Exemption

The 2020 Washington State estate tax exemption is currently $2,193,000 per person, the same rate as 2019. The law states that the Washington State exemption increases based on the consumer price index for the Seattle-Tacoma-Bremerton area. However, in 2018 the index was changed to the Seattle-Tacoma-Bellevue index. Without a corresponding change to the law, the State has no index to use and thus, the exemption remains unchanged. If the law is changed to reference the new index, then this rate should increase. Washington estates in excess of the exemption amount are subject to a 10% – 20% Washington State Estate Tax.

Federal Gift Tax Annual Exclusion

The federal annual gift tax exclusion remains at $15,000 for 2020.

Federal and State Tax Summary

The chart below outlines the federal and state exemptions and tax rates for 2016 through 2020.

Estate Planning Update

SECURE ACT OF 2019

The Setting Every Community Up for Retirement Enhancement Act of 2019 (the “SECURE Act”) was signed into law in December 20, 2019. The purported goal of the SECURE Act is to encourage individuals to save more for retirement. While the SECURE Act made approximately 30 changes to current laws, we have highlighted the changes that may affect you.

- Increased the Age for Required Minimum Distributions. The SECURE Act increased the age that a participant must be to take required minimum distributions (“RMDs”). For those of you turning 70½ after 2019, your RMDs will now begin when you reach age 72. Everyone can still take penalty-free withdrawals after age 59½ , but it will allow those who wish to delay withdrawals for a little bit longer, the ability to do so. However, the increased age requirement applies only to participants who turn 70½ after December 31, 2019. In other words, if you are already required to take RMDs, nothing will change. You will need to continue your RMDs in 2020, despite the fact that you may be under age 72.

- Eliminated the Stretch-IRA. For deaths occurring after December 31, 2019, a beneficiary who inherits an IRA will no longer be able to take IRA distributions based on his/her life expectancy. This change will have no effect on IRAs inherited prior to December 31, 2019.

Under the SECURE Act, the inherited IRA must be completely withdrawn within 10 years of the date of the participant’s death. It is important to note that no RMDs are required during the 10-year period; amounts may be withdrawn in any amount over the 10-year period. The only requirement is that the entire amount must be distributed at the end of the tenth year. There are a handful of beneficiaries who are not subject to this 10-year payout rule, most notably, (a) a surviving spouse, (b) a chronically ill heir, and (c) a disabled heir. These beneficiaries will continue to be able to stretch withdrawals out over their lifetimes. Additionally, if a minor beneficiary inherits an IRA, the 10-year clock does not begin to run until the minor turns 18 years of age.

The elimination of the stretch IRA affects a large number of clients’ estate plans. For instance, if you are paying your retirement benefits to a conduit trust for children, your children may receive the entire IRA within 10 years of your death, regardless of the trust provisions. Additionally, this change will affect beneficiaries receiving inherited IRAs. Distributions from pre-tax accounts are subject to ordinary income tax rates, which could result in some significant tax bills. If the beneficiary is a trust, it will be paying income tax on the IRA distribution, most likely at the top income tax bracket. We encourage you to speak with your estate planner regarding your options to defer taxes, prevent premature access by your children, and maximize your overall IRA benefit.

- Eliminated the Maximum Age for Contributions to IRAs. Prior to January 1, 2020, an individual needed to be under age 70½ to make a deductible contribution to a traditional IRA (you could continue to contribute to a ROTH IRA or a 401(k) assuming you had earned income). After January 1, 2020, the age restriction was removed.

- Reduced Qualified Charitable Distribution Exclusion. Prior to January 1, 2020, each taxpayer over the age of 70½ was able to make a charitable distribution of up to $100,000 per year from a traditional or Roth IRA (“QCD”) and exclude this amount from his/her income. The SECURE Act reduces the amount of the QCD that the taxpayer can exclude from income by contributions made to the IRA after the taxpayer attained age 70½. Note, this age limitation did not get increased to age 72, creating a disconnect between the onset of RMDs and the ability to make QCDs.

- Increased Access to Multiple Employer Plans for Small Businesses. As of January 1, 2020, small businesses have greater access to Multiple Employer Plans (“MEP”) through (a) relief from the one-bad-apple rule (which caused the entire MEP to fail if one participant failed to meet plan qualification requirements) and (b) the ability for employers to create MEPs despite any shared characteristics (such as being in the same industry) with other participants.

- Added Penalty-Free Withdrawals for a Birth/Adoption. There are a handful of circumstances when you can make withdrawals from your retirement plan, without any penalties prior to turning age 59½. The SECURE Act adds one more circumstance – the birth or adoption of a child. Under the new Act, you can withdraw up to $5,000 for the birth or adoption of a child. However, the withdrawal is subject to income tax, so it may not be the wisest source of funds to use.

- Permits Payment of Student Loans from 529 Plan Accounts. As of January 1, 2020, you can use up to $10,000 (lifetime) from a 529 account to repay student loans. While this may provide a slight benefit to those living in Washington, it will provide a larger benefit to those living in states where you receive a state income tax deduction for contributing to a 529 plan.

- Modification of the Kiddie Tax. Historically, a tax has been imposed on certain unearned income of a child (nicknamed the ‘‘kiddie tax’’). Initially this income was taxed at the parents’ bracket. Under the 2018 Tax Cuts and Jobs Act, such income became taxable at ordinary and capital gains rates applicable to trusts and estates. The SECURE Act removed the 2018 change, so such income is once again taxable at the parents’ brackets. While this change has nothing to do with retirement, it somehow found its way into the SECURE Act.

Tax Fun Fact #1: In 2019, a person worked an average of 105 days to pay his or her taxes.

HUMAN COMPOSTING AND ALKALINE HYDROLYSIS – GREENER DISPOSITION OF REMAINS IN WASHINGTON

Washingtonians will soon have two new greener options for the disposition of human remains. In May 2020, natural organic reduction (a.k.a. human composting or decomposition) and alkaline hydrolysis (a.k.a. aquamation, green cremation, and liquid cremation) will be legal options for the disposition of remains. While many states already permit alkaline hydrolysis (hereafter, “aquamation”), Washington will be the first state to allow human composting.

- Aquamation. Like cremation, aquamation reduces human remains to bone fragments (similar to cremated ashes) that can be returned to family and friends to be scattered or stored. Aquamation uses approximately 10% of the energy that is used for flame-based cremation, with no emissions of mercury, carbon dioxide, or particle matter into the air. Water and an alkali solution of sodium hydroxide or potassium hydroxide (not an acid – on the opposite end of the pH scale from acid) are heated to speed up the decomposition process. After about 3 hours, tissues are dissolved and only bones remain. The water involved in the aquamation process is then either processed like other wastewater or given to farmers to use in agriculture (such as sod farming).

- Human Composting. Human composting will reduce human remains to useable soil (a cubic yard – or several wheelbarrows of soil) that can be returned to friends or family to be used in a garden or donated to conservation efforts. Washington State University conducted the initial study to determine if human remains could be safely and effectively composted. The WSU study revealed that the resulting compost smelled like soil (and nothing else), met or exceeded state and federal safety standards (reducing or killing pathogens, soluble metals, and pharmaceuticals), and was unrecognizable as human remains (chemically, microbiologically, and visually).

Recompose, Inc. a Seattle company that sponsored the research at WSU, hopes to open a facility in late 2020 or early 2021 that will feature approximately 75 reusable vessels for human composting. A body will be placed in an aerated vessel and covered with wood chips, alfalfa, and straw (a process that they hope family and friends will be involved with like a memorial service). The vessel creates an environment for naturally occurring microbes and bacteria to compost a body in approximately four weeks. According to its website, Recompose Inc. estimates that a metric ton of carbon dioxide will be saved each time someone chooses organic reduction over cremation or conventional burial.

Tax Fun Fact #2: In Colorado, coffee cup lids (but not coffee cups themselves) are considered nonessential packaging and are taxed at 2.9%.

REVIEWING AND UPDATING YOUR ESTATE PLAN

While an estate plan is generally designed with some flexibility, it reflects a snapshot of your life at the time it was created. As life changes, there are certain events that may prompt you to update some or all of your estate planning documents (such as your will, revocable living trust, financial power of attorney, health care power of attorney, or your health care directive). In addition to changes in the laws, if any changes below have occurred, it might be time to update your documents:

- Relationship Changes. Marriage, divorce, and death are common reasons to update your estate plan. However, it isn’t just your relationships to monitor – it is also those of your fiduciaries, such as your personal representative (a.k.a. your executor) and the trustee of your children’s money. For example, you may have named a brother and his spouse as guardian of your minor children. If your brother’s marriage dissolves, you may not want his spouse involved. Moreover, as a single parent, your brother may not have the capacity to care for more children. Alternatively, you may have named your sister as your health care agent prior to her move overseas. Now that she is in a different time zone, she may no longer be the best suited to making immediate decisions for you. When thinking about your documents, be sure to focus on all relationships, not just your own.

- Additions to your Family. Many people have included grandchildren (and step-grandchildren) in their estate plan. When a new grandchild is born or adopted, you should make sure you update your documents to include such grandchild. With the rising cost of education, many grandparents are assisting their children with tuition payments for the grandchildren. You may also want to consider creating a gift plan to ensure that funds are set aside for education.

- Financial Changes. Changes in your financial situation, whether due to a medical event, a sale or acquisition of a business, or simply due to retirement, may necessitate a review of your estate plan. Tweaks may be needed to ensure it is still the most tax-efficient structure to suit your circumstances.

- Residency Changes. While your estate plan will be enforceable wherever you move in the US, you may need to update it after a move to ensure you take full advantage of, and are not penalized by, the laws of your new state. For instance, some states have onerous and expensive probate fees, and you will want to avoid probate in those states. Other states may subject the income of your trust to tax if you have a fiduciary who is a resident of such state. Additionally, if your Trustee is a Canadian citizen who has moved back to Canada, your trust may be taxable as a foreign Trust. To ensure that you’re not exposed to more tax than necessary, you should revisit your estate plan following any move.

- Circumstantial Changes. There are many other changes that may prompt a review/update of your plan, including the following:

- A fiduciary or a beneficiary of your estate becomes disabled, develops an overspending/gambling habit, or becomes addicted to drugs/alcohol.

- Your child turns 18 (for more information, please request our primer entitled What to do When your Child Turns 18).

- Your charitable giving goals have changed.

- You’ve changed careers and have new/different benefits (including life insurance).

- You purchase a vacation home in another state (ideally you should contact your estate planning attorney prior to the purchase to help streamline the process).

Generally, we recommend reviewing your estate plan every two to three years to ensure your intentions are still the same. Often changes are not needed that frequently, but it is a way to refresh your recollection and ensure that changes are made before your documents become dangerously outdated.

If you have any questions regarding the above information or if you wish to update any aspect of your estate plan, please don’t hesitate to contact us.