2023 Estate Planning Update

Estate Tax Update

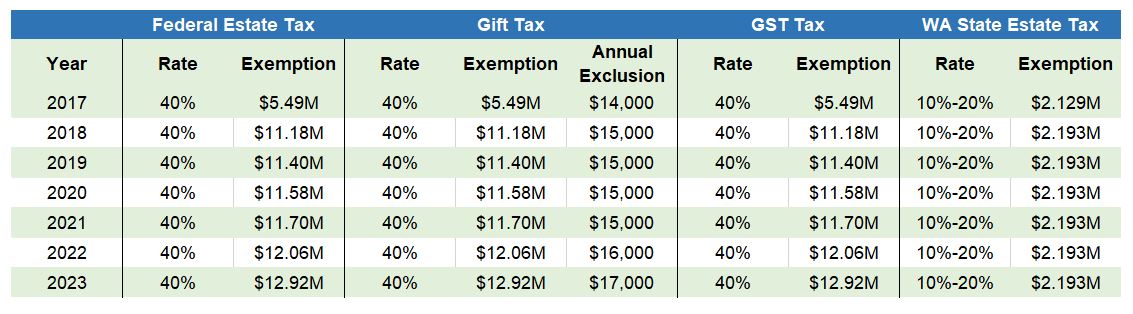

Federal Estate Tax, Gift Tax and Generation-Skipping Tax Exemptions

The 2023 federal exemption against estate and gift taxes is $12,920,000 per person. This is an increase over the 2022 exemption, which was $12,060,000 per person (the increase reflects an inflation adjustment). The exemption is expected to drop by 50% at the end of 2025. Gifts and estates in excess of the exemption amount are subject to a 40% federal estate tax. The federal generation-skipping transfer tax exemption was also increased to $12,920,000 per person.

State Estate Tax Exemption

The 2023 Washington State estate tax exemption is currently $2,193,000 per person, the same rate as 2022. The law states that the Washington State exemption increases based on the consumer price index for the Seattle-Tacoma-Bremerton area. However, in 2018 the index was changed to the Seattle-Tacoma-Bellevue index. Without a corresponding change to the law, the State has no index to use and thus, the exemption remains unchanged. If the law is changed to reference the new index, then this rate should increase. Washington estates in excess of the exemption amount are subject to a 10% – 20% Washington State Estate Tax.

Federal Gift Tax Annual Exclusion

The federal annual gift tax exclusion increased to $17,000 per person, per donee. This is an increase from the 2022 rate of $16,000.

Federal and State Tax Summary

The chart below outlines the federal and state exemptions and tax rates for 2017 through 2023.

(click to enlarge)

(click to enlarge)REQUIRED MINIMUM DISTRIBUTIONS are back FOR INHERITED IRAS!

In October 2022, the IRS released Notice 2022-23 to announce that it never intended to eliminate Required Minimum Distributions (RMDs) for inherited IRAs following the death of the participant and that the Internal Revenue Code and its corresponding regulations have been misinterpreted.

Background.

Prior to 2020, a retirement plan participant had to begin taking RMDs from his/her account at age 70½. Following the participant’s death, the designated beneficiaries had to continue taking RMDs, although the rate and amount of the RMDs depended on (1) the age of the participant at his/her death, and (2) the identity of the beneficiaries. If there was no identifiable individual as a designated beneficiary, the funds generally needed to be withdrawn within five years following the participant’s death (5-year rule). Under the 5-year rule, there was no RMD requirement.

The SECURE Act.

The passage of the SECURE Act, effective January 1, 2020, made some significant changes to retirement plans. First, it changed the age at which a participant must begin taking RMDs, increasing it from 70½ to 72. Second, it changed the rate that distributions must be taken from an account following the death of the participant. This second change has created confusion.

New 10-Year Rule.

The SECURE ACT attempted to simplify the payout of inherited IRAs following the death of the participant. Except for certain exceptions, the Act states that following a participant’s death, a beneficiary of an inherited IRA has 10 years to withdraw the funds (10-year rule).

Confusion.

The SECURE Act failed to state whether RMDs would be required during the 10-year period. Practitioners applied the new 10-year rule like the old 5-year rule and assumed that RMDs were eliminated. They interpreted the new rule to mean that as long as the entire inherited IRA was withdrawn within the 10-year timeframe, it could be done at any pace. In other words, beneficiaries could take 1/10th each year, take sporadic amounts over the 10-year period, or take no withdrawals until year 10 at which time they could withdraw the entire amount.

With the release of Notice 2022-53, the IRS clarified its position that it never intended to eliminate RMDs. Specifically, the IRS stated that a designated beneficiary of an inherited IRA must take RMDs each year (and may take more) and the entire account must be withdrawn before the end of the 10th year.

Penalties/Excise Taxes.

If a beneficiary fails to take RMDs, there is an excise tax equal to 50% of the amount that should have been withdrawn. In 2020, the CARES Act (the Coronavirus Aid, Relief, and Economic Security Act) eliminated the requirement for beneficiaries to take RMDs during the 2020 calendar year. However, because of the poor wording of the SECURE Act, most beneficiaries failed to take RMDs in 2021 and 2022, leaving them exposed to extremely high penalties. In Notice 2022-53, the IRS states that it will suspend the excise tax for unwithdrawn RMDs for calendar years 2021 and 2022. However, the IRS intends to impose the penalties on any RMDs not withdrawn in 2023 and future years.

Going Forward.

Many beneficiaries of inherited IRAs have met with their tax advisors and have created plans as to when and how they will withdraw the IRA over a 10-year period. Given this new interpretation by the IRS, we strongly encourage beneficiaries to meet with their tax advisors to ensure they comply with the IRS’s new interpretation.

Generally, we recommend reviewing your estate plan every two to three years to ensure your intentions are still the same. Often changes are not needed that frequently, but it is a way to refresh your recollection and ensure that changes are made before your documents become dangerously outdated.

If you have any questions regarding the above information or if you wish to update any aspect of your estate plan, please don’t hesitate to contact us.