2025 Estate Planning Update

Estate Tax Update

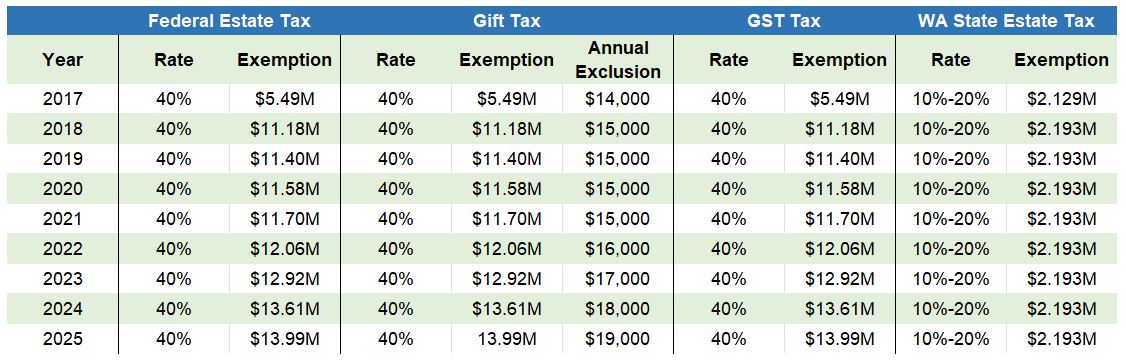

FEDERAL ESTATE TAX, GIFT TAX, AND GENERATION-SKIPPING TAX EXEMPTIONS

The 2025 federal exemption against estate and gift taxes is $13,990,000 per person. This is an increase over the 2024 exemption, which was $13,610,000 per person (the increase reflects an inflation adjustment). Unless Congress takes action, the exemption is expected to drop by 50% at the end of 2025. Gifts and estates in excess of the exemption amount are subject to a 40% federal estate tax. The federal generation-skipping transfer tax exemption was also increased to $13,990,000 per person.

STATE ESTATE TAX EXEMPTION

The 2025 Washington State estate tax exemption is currently $2,193,000 per person, the same rate as 2024. The law states that the Washington State exemption increases based on the consumer price index for the Seattle-Tacoma-Bremerton area. However, in 2018 the index was changed to the Seattle-Tacoma-Bellevue index. Without a corresponding change to the law, the State has no index to use and thus, the exemption remains unchanged. If the law is changed to reference the new index, then this rate should increase. Washington estates in excess of the exemption amount are subject to a 10% – 20% Washington State Estate Tax.

FEDERAL GIFT TAX ANNUAL EXCLUSION

The federal annual gift tax exclusion increased to $19,000 per person, per donee. This is an increase from the 2024 exclusion amount of $18,000.

FEDERAL AND STATE TAX SUMMARY

The chart below outlines the federal and state exemptions and tax rates for 2017 through 2025.

WASHINGTON ESTATE TAX – NEW FILING RULES

Prior to January 1, 2025, when a married Washington resident died, his/her estate included his/her separate property and one-half interest in all community property, including the personal residence. If the deceased spouse’s estate was $2,193,000 or above, he/she was required to file a Washington estate tax return. Because the value of real estate in Washington has grown astronomically over time, many Washington residents were required to file largely due to the value of their home.

To eliminate this burden on both the taxpayer and the Department of Revenue, the Washington legislature has amended the filing requirement. If a spouse dies after January 1, 2025, his/her estate can exclude the value of his/her personal residence from determining whether they meet the $2,193,000 filing threshold. In other words, if the deceased spouse’s gross estate value (without the value of their personal residence) is below the filing threshold of $2,193,000, then no return is required to be filed with Washington State.

The exemption is only used for determining if a return needs to be filed. If a deceased spouse’s gross estate, without the personal residence, meets the $2,193,000 filing threshold, a return will need to be filed. When a return is required to be filed, the decedent’s share of the personal residence will need to be included in the gross estate.

WASHINGTON STATE CAPITAL GAINS TAX UPDATE

After the recent election, it looks like Washington’s capital gains tax is here to stay. The tax, which is indexed for inflation, applies a 7% rate to capital gains exceeding $270,000 for the 2024 tax year (taxes due in April 2025).

Importantly, not all capital gains are subject to this capital gains tax. Exemptions include:

- Real estate

- Assets held in retirement accounts

- Certain small business sales, provided they meet specific criteria

Additionally, taxpayers can take advantage of a charitable donation deduction, which allows a portion of qualifying contributions to reduce taxable gains. For 2024, the charitable deduction threshold is $270,000, with a maximum of $108,000 that can be deducted.

SECURE ACT 2.0 and IRAs

The SECURE Act 2.0 introduced several changes to the rules affecting Individual Retirement Accounts. The changes for 2025 include:

Increased Qualified Charitable Distribution (QCD) Limit: Individuals who are 70 1/2 or older may make charitable donations directly from their taxable IRAs and have it count against their required minimum distribution (RMD) instead of taking a withdrawal, declaring it as income, making a gift to a charitable organization, and then taking a charitable deduction. The 2025 amount that can be rolled directly from an IRA to a charitable organization is now $108,000 per individual.

One-Time QCD to Split-Interest Entities: A one-time QCD of up to $54,000 can now be made to certain charitable trusts or gift annuities, offering more flexibility for charitable giving.

RMD Ages: The RMD age depends on the year you were born:

- 1949–1950: RMD age is 72

- 1951–1959: RMD age is 73

- 1960 or later: RMD age is 75

529 Plan Rollovers to Roth IRAs. Beginning in 2024, the SECURE Act 2.0 allowed funds to be rolled from a 529 plan account into a beneficiary’s Roth IRA, provided the following conditions are met:

- The 529 plan must have been open for at least 15 years.

- Contributions made in the last five years (and their earnings) are ineligible for rollover.

- Rollovers are capped at a lifetime maximum of $35,000 per beneficiary.

- Rollovers count toward annual Roth IRA contribution limits ($7,000 for individuals in 2025).

- The beneficiary must have earned income equal to or greater than the rollover amount in a given year.

Updated Rules for Inherited IRAs. On July 18, 2024, the IRS released its long-awaited new final regulations for required minimum distributions along with some new additional proposed regulations. These are designed to answer questions that arose following the passage of the SECURE Act. These regulations did the following:

- Confirmed that non-designated beneficiaries of Inherited IRAs must take RMDs annually but only if the deceased plan participant died on or after his/her required beginning date (i.e. the participant was taking RMDs before his/her death). Previously, the prevailing theory was that beneficiaries could take as much or as little as they wanted in years 1-9 after death, as long as it was all out by the end of Year 10.

- Confirmed that if a beneficiary of an inherited IRA failed to take RMDs in 2021 through 2024, there will be no penalty and no requirement to make up the missed distribution. In other words, the RMD requirement for inherited IRAs officially starts in 2025.

- Confirmed that if an individual has not taken an RMD in the year of death, the named beneficiaries of the IRA must take the distribution for that year. If there are multiple beneficiaries on the IRA, such distribution may be allocated among the beneficiaries in any proportion they choose.

- Confirmed that the year of death RMD distribution may happen without penalty by December 31st of the year after the year of death, giving beneficiaries time to satisfy the final year distribution requirement for deaths that happen late in the year.

- Confirmed that Inherited Roth IRA beneficiaries are subject to the 10 year payout rule, but they are not subject to RMDs within the 10 year period.

2017 TAX CUTS AND JOBS ACT – SUNSETTING?

Background. The Tax Cuts and Jobs Act of 2017 (TCJA) increased the unified estate and gift tax exemption to historically high levels and made numerous other changes to the tax code (including increasing the standard deductions, changing the individual income tax brackets, and capping the state and local tax deduction). The law was passed through a reconciliation process, which allows significant changes to be made to the tax code with only a simple majority vote, rather than the typical 60-vote threshold. To comply with the Byrd Rule, which prevents legislation from increasing the budget deficit beyond 10 years, most of the tax cuts related to individuals and businesses will expire on December 31, 2025. Tax practitioners and clients have been anxiously awaiting the outcome of the 2024 elections to speculate about the future of the TCJA and whether Congress will act to extend the heightened estate and gift exemption.

Potential Future Action. President Trump discussed tax reform in numerous campaign speeches, stating his desire to extend the tax cuts and even make them permanent. With Republicans holding majorities in the House and Senate, we anticipate a change, but whether we get a full extension, a partial extension or a hybrid is unknown.

Full Extension. If all expiring provisions of the TCJA are extended beyond 2025, there would be a significant increase in the federal budget deficit. Estimates by the Congressional Budget Office and the Joint Committee on Taxation state that a full TCJA extension would result in a federal primary deficit of $1.2 trillion over a five-year period and $3.3 trillion over a decade. This creates a hurdle to making these cuts permanent.

Partial Extension. Congress may consider extending some provisions that benefit low and middle income taxpayers while letting the provisions that benefit wealthy individuals expire. For example, they can let the top income bracket now at 37% revert back to its higher rate of 39.6%. According to the Center for Strategic and International Studies (CSIS), targeted extensions could result in a tax hike for the top 0.1 percent of taxpayers, but they would increase the deficit significantly less than a full extension.

Combination of Extensions and New Policies. Congress could also adopt a hybrid approach which extends some TCJA provisions (such as the increased standard deduction, maintaining the state and local tax deduction cap, the child tax credit, and the home mortgage deduction), while discontinuing other provisions (such as the lowered individual tax rates; higher estate tax thresholds; and pass-through business income deductions). They could then create new tax policies including additional funding for the Internal Revenue Service to reduce the loss caused by non-filing, underreporting, and underpayment of taxes (estimated at $496 billion for 2014–16). The right combination of extensions and new policies could be revenue neutral or even be revenue positive.

Recommendations. While we know that there will be change in the tax policy, there is significant uncertainly as to whether the estate and gift tax exemptions will remain at their current levels. Until they are actually extended, we are encouraging clients to plan for what we know – that the increased estate and gift tax exemption will expire after December 31, 2025. If you have not revisited your existing estate plan in recent years, we strongly encourage you to meet with your estate planning attorneys to establish any trusts or gifting plans in early 2025 and identify what assets you may move (but not actually make the transfers). As the sunset deadline approaches and the future of the TCJA is (hopefully) more certain, you can be ready to move quickly if needed.

The CORPORATE TRANSPARENCY ACT ROLLER COASTER

On January 1, 2024, the Corporate Transparency Act (“CTA”) took effect, requiring most small partnerships, limited liability companies, and closely-held corporations to report information about their beneficial owners to the Financial Crimes Enforcement Network (“FinCEN”). The goal of the CTA is to help law enforcement combat money laundering and other financial crimes. If these entities were in existence prior to 2024, they needed to report their beneficial owners by December 31, 2024.

On December 3, 2024, a federal district court in Texas held that the CTA was “likely unconstitutional” and issued a nationwide injunction on the CTA’s reporting requirements.

On December 23, 2024, the Fifth Circuit Court of Appeals reinstated the enforcement of the CTA’s reporting requirements. To give business owners time to catch up, the federal government pushed the filing deadline to January 13, 2025.

On December 26, 2024, a different panel of the US Court of Appeals for the Firth Circuit issued an order vacating the Court’s December 23rd order granting a stay of the preliminary injunction. Is your head spinning yet?

As of December 26, the injunction is in effect and the reporting is currently voluntary. However, on January 1st, the US Department of Justice asked the US Supreme Court to halt the injunction. As of the date of this writing, no further guidance has been provided.